Saturday, February 27, 2010

Head of IMF wants global currency

"He said having other alternatives to the dollar 'would limit the extent to which the international monetary system as a whole depends on the policies and conditions of a single, albeit dominant, country.'"

Friday, February 26, 2010

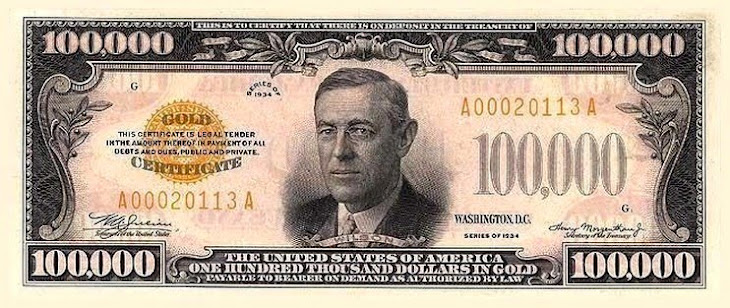

Gold Watch

"[Gold] recently broke from its usual inverse relationship with the U.S. dollar to move more in sync with the climb in the greenback, showing off its prowess as a resilient world favorite."

"In a world where governments are openly devaluing their fiat currencies in an attempt to ease increasing stimulus debts and increase exports, central banks are figuring out the best way to preserve their wealth: the U.S. dollar and gold. Look for them to trade up together," he said.

"Gold's ability to rise in most major currencies is suggesting people are choosing it as an alternative to paper currencies," said Peter Grandich, a metals writer at Agoracom.com. And people are choosing the precious metal "because of the huge amount of debt the western world has piled up and the belief the only way out from under it is to reflate."

Wednesday, February 24, 2010

Bracing for Higher Interest Rates

Higher interest rates are coming.

That was the unmistakable message from the Federal Reserve last week when it increased the discount rate, the rate it charges banks for borrowing reserves. Although the move came sooner than many expected, it was a healthy step toward more normal conditions and a sign the banking system is healing. The Fed stressed that the move doesn't mean any imminent rise in the more important federal-funds rate. Despite the soothing words, it's a clear warning that near-zero interest rates won't last forever, and that the Fed is prepared to act when necessary to raise rates.

---> However, the article stresses that "inflation hedges" such as gold are over-valued and recommends rebalancing your portfolio with no real sense of urgency over the next three months.

Monday, February 22, 2010

Sunday, February 21, 2010

WaPo - Inflation falls to lowest since 1982

- One must trust government numbers...

"When energy and food costs are added in, consumer prices overall rose 0.2 percent, the Labor Department said. But the core figure is widely considered a more precise gauge of long-term inflation trends."

- So core inflation is 2.4% annual less volatile energy/food. Not exactly "lowest in 28 years."

"The Fed does not think that inflation will be a problem through this year, if only because the economy is still in a wobbly recovery. When people are out of work and don't have as much money to spend as they used to, there's less demand for goods, which keeps inflation down. Institutionally, that's the Fed's view. "

- And the Fed's view on a 10X money supply and trillions in deficits?

"But not every Fed policymaker agrees. In a speech Thursday, St. Louis Federal Reserve Bank President James Bullard said the financial markets are expecting inflation to pick up, citing increased spreads between yields on ordinary Treasury securities and inflation-protected Treasury securities, whose principal rises and falls with prices. If inflation-protected Treasuries are selling at a faster clip, that means people are worried inflation will rise. "

- I'll be keeping my eye on what James Bullard has to say going forward...

Thursday, February 18, 2010

TBT chart check-up

Today's action indicated continued technical strength with a close today right at 50:

Tepid investors could certainly wait until the 50-day moving average crossed over the 200-day, though this is a long term plan (2-3 years overall) so their is no harm in waiting as opposed to getting in earlier, especially if you personally think interest rates are going to drop. Some perspective is helped by also viewing the 3-month chart next to the 2-year:

Setting up nicely for a bull run, wouldn't you say? Let's go TBT!

Methodologies:

BABY BEAR: Long stock, 2 shares for every 100 bucks. Go nuts.

MAMA BEAR: A little more leverage: Jan-2011 calls at 53 for 4.15. (close on Feb 18). You have 12 times the gain potential but limited time (10 months). You control 24 shares for every 100 bucks, but need 57.15 or higher by next January to break even.

PAPA BEAR: Bull call spread, buy the Jan11-50 calls at 5.40, and sell the 60 calls for 2.30. You're risking $3.10 to make $10. The probability of a 10 point move is more than 50/50, making this a lower risk than it appears. $322 potential per $100, but you have set a target for 60.

Personally, I like the mama bear play, because it doesn't cap the upside should things really get moving.

Dollar strengthens as inflation rate rises

NEW YORK, Feb. 18 (Xinhua) -- The dollar extended gains on Thursday as wholesale prices increased more than expected last month.

The U.S. Labor Department reported that the producer price index for finished goods rose a seasonally adjusted 1.4 percent in January on the back of higher energy costs, much higher than analysts had expected. The core PPI, which excludes volatile energy and food prices, rose 0.3 percent, also higher than the expectation of 0.1 percent.

The Fed has left key interest rates at a record low levels as risk of inflation was kept in check. Rising wholesale inflation may weigh on Fed's decision on when to start tightening credit.

The latest statement from Fed, which was released after market closing on Thursday, said the central bank decided to increase the overnight loan rates it charges banks by 25 basis points to 0.75 percent.

The dollar was boosted as speculation of higher interest rates lured more investors.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/quotes_7a.gif)